Reduce Costs,

Enhance

Member Experience

Move At the Speed of your members

Your members live in a world of evolving technology and tools, easily accessible and seamlessly integrated into their everyday lives.

Give members instant access to money movement

Integrate your apps, core or digital banking fast with pre built connectors in several programming languages.

Reserve Your Spot!Open Banking goes

hand-in-hand

with Credit Unions

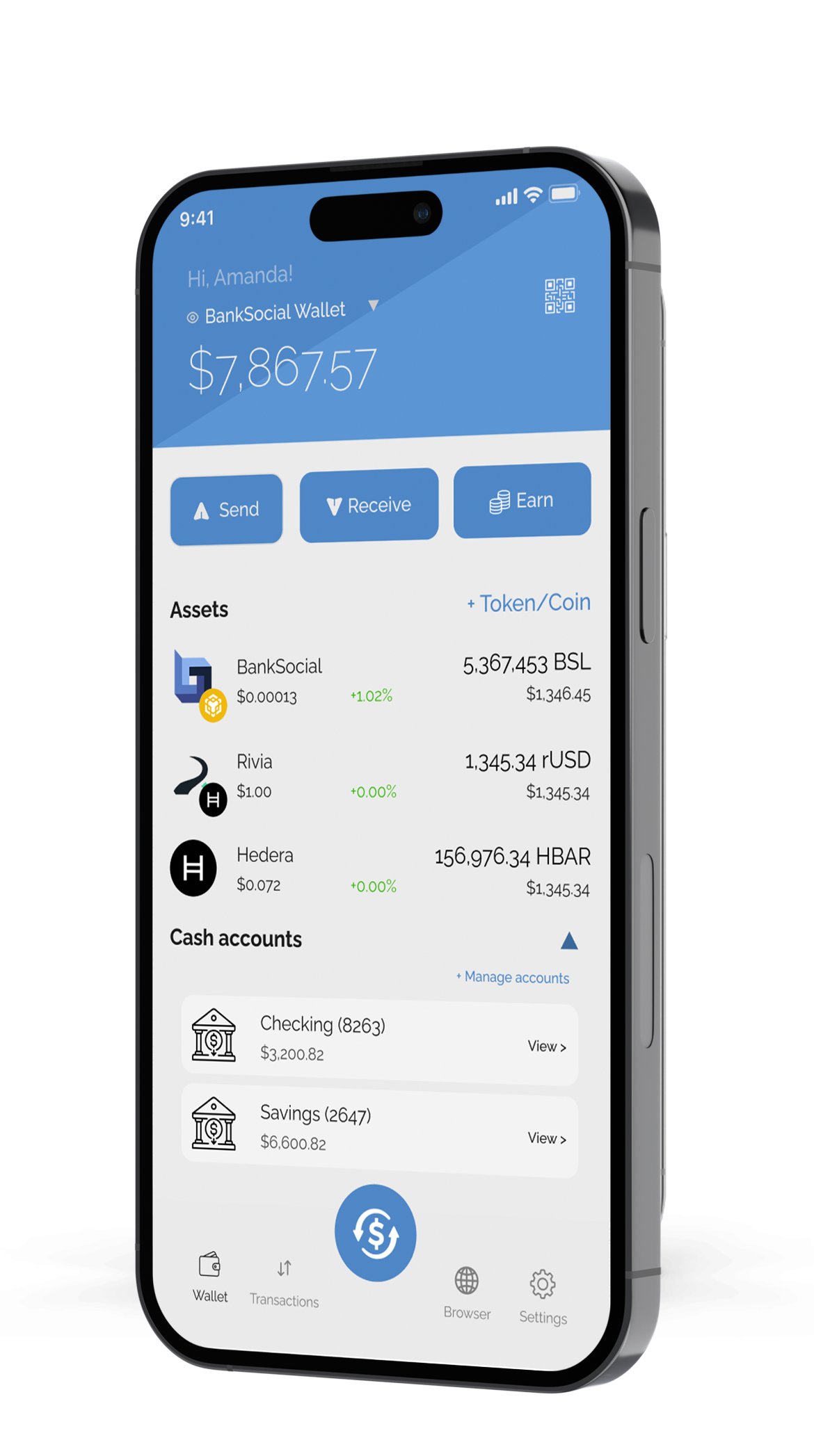

The future of finance is now. Open banking gives individuals control of their assets and control over their own financial tools. We have been inspired by the power of credit unions and open banking to bring the ability for members to send/receive payments via a robust Payments Hub, self-custody of digital assets, online account opening and portable identity, all via the first 100% redesigned from the ground up digital wallet and open banking platform, purpose built for Credit Unions.

-

Your Members are falling behind

Stay ahead in the financial evolution—offer your members seamless digital wallets and payment solutions tailored for modern banking.

-

Meet today, Launch Tomorrow

Effortlessly implement cutting-edge digital wallet and payment solutions with quick onboarding—empower your credit union to launch immediately.

-

Evolve Your Members Experience

Transform your members' experience with cutting-edge digital wallets and payment systems—boost engagement, satisfaction, and loyalty effortlessly.

Real Time Payments

For your Members

- Pay Gig Workers in Real Time

- Immediate Payroll

- Mitigate Fraud

- Low Cost Receive Only Implementation